The future of Pet Food: insights into emerging market trends

At a time when Pet Care transcends mere ownership, and dogs and cats in particular are increasingly considered members of the family, the Pet Food industry is experiencing an unprecedented surge.

Especially during the pandemic, a marked increase in pet adoption emerged, translating into a heightened focus on Pet Care. This trend is not merely a flash in the pan but a sustained movement, with the pet adoption rate in 2021 reaching a six-year high.

The global Pet Care market, which soared to €163.94 billion in 2022 and is projected to reach €247.80 billion by 2028, mirrors the importance pets hold in today's society. In the United States alone, Pet Care, especially Pet Food, constitutes a significant portion of consumer spending, reflecting a broader, more ingrained commitment to pet welfare.

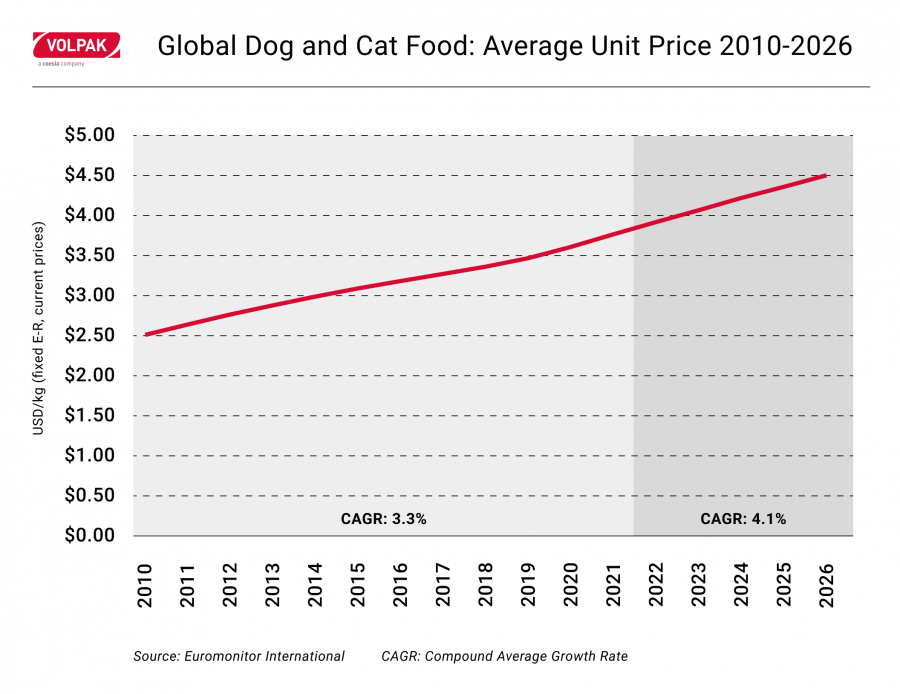

Consequently, over the past decade, the average cost of pet products has experienced a compound annual growth rate (CAGR) of 3.3%, with a projected growth of 4.1% over the next five years (2022-2026). While in 2010 the average cost of a pet product was USD 2.5, this cost is expected to reach USD 4.5 in 2026.

This change is largely fueled by the evolving relationship between pet owners and their beloved animals. New consumer behaviors are shifting towards the demand for premium pet products.

Evolving purchase channels in Pet Care

Pet owners' purchasing behavior reflects an increasingly marked omnichannel reality. Although there's still a strong loyalty to brick-and-mortar stores, expected to continue holding the majority share of the global market in the near future, the restrictions of 2020 prompted many consumers to reassess the option of online purchases, even for Pet Care products.

E-commerce has seen its market share in the Pet Care sector grow from 18% in 2019 to 29% in 2023, while offline retail maintains a solid hold with 67% of the market. In geographical areas such as America and the Asia Pacific, the online channel is consistently gaining ground, with over half of all Pet Care sales conducted online in countries like South Korea and China. Meanwhile, physical stores continue to experience growth in emerging markets like Latin America, the Middle East, and Africa.

On one hand, e-commerce leverages leaner logistics and offers a wider choice of items, price ranges, and formats, paving the way for subscription-based services that represent a valuable solution for recurring purchases, promoting customer loyalty and retention. On the other hand, physical pet shops are focusing on benefits such as in-store consultations and additional services like grooming, spas, or veterinary assistance. It's also worth mentioning the role of discounters, which, although being a smaller channel, are gaining momentum due to the decreasing purchasing power of consumers, who are looking for more affordable options.

This dynamism in purchasing channels underscores not just the rapid evolution of consumer markets, especially thanks to e-commerce, but also how companies in the Pet Care sector have to adapt their strategies to meet the needs and preferences of customers in increasingly innovative and personalized ways.

Flexible packaging excellently meets the demands for adaptability in format changes and storage convenience. Doypack, for instance, can be swiftly adjusted to accommodate smaller volumes and offers significantly easier storage options.

The drive toward premiumization

As pets increasingly become an integral part of the family, the demand for premium, high-quality Pet Food has skyrocketed.

Amidst economic fluctuations, the Pet Care sector has shown remarkable resilience, especially within its premium segment. Despite the broader impact of inflation, which has led to a polarizing effect on consumer spending habits, the premium Pet Food market has remained robust.

The desire for premiumization in Pet Food is a discernible trend that emphasizes creating elevated experiences for pets and their owners. This shift towards healthy, natural, and even vegan options has led to the emergence of a new market segment: treats and mixers that mirror human snacks in form and function, catering to pet owners' will to look after their pets with the same care and consideration they afford themselves. At the heart of this is the focus on curated offerings and unique interactions that strengthen the human-pet bond and reinforce the emotional connection, providing moments of shared joy and companionship that go beyond basic care to ensure the highest quality of life for furry companions.

Flexible packaging: a sustainable and practical option

In this context, one of the fastest-growing segments within the Pet Food industry is flexible packaging, reflecting not only a change in packaging preferences but also increased premiumization and innovation in the field.

The right packaging goes far beyond aesthetics; it becomes a statement of intent from manufacturers about their environmental responsibility and commitment to pet health.

At the heart of this transformation, there’s the need for flexible packaging solutions, epitomized by the pouch—a preferred choice for its convenience, efficiency, and environmental friendliness.

Pet owners' concern for the future of the planet is intensifying, driving them toward environmentally friendly products for their pets. This shift underscores the growth potential of more sustainable ingredients and packaging.

Also confirming this, is a lifestyle survey conducted by Euromonitor, which shows that 66% of pet owners worldwide are concerned about climate change and strive to have a positive impact on the environment through their choices.

Meeting this need requires manufacturers to adopt sustainable practices in sourcing and product development, promoting innovative strategies to reduce their ecological footprint.

Volpak's commitment to the next-gen Pet Food packaging

Volpak has adeptly responded to the evolving needs of the Pet Food industry with its extensive portfolio of pouching machinery. This suite of advanced technology not only ensures the integrity of seals and accommodates a diverse range of packaging sizes and materials but also addresses the intricate demands of the industry—particularly for dry treats and wet Pet Food—with unparalleled expertise.

Volpak's machinery is designed to produce attractive, leak-free pouches that are cost-effective alternatives to pre-made options. These machines boast the latest features, including seal integrity kits, press-to-close, and hook-to-hook closing systems, alongside single or multiple fill stations, allowing for the simultaneous processing of varied product types—be it crunchy kibble or moist food.

The long experience in the Pet Food market allows the creation of crafting solutions that meet the demands for quality, rapid pouch size changes, and impressive production capacities of up to 360 pouches per minute.

Moreover, sustainability is evident in every solution provided, that is suitable to work with 100% recyclable materials.

Volpak’s commitment to eco-friendly materials and processes not only meets the market’s demands but sets it apart as a visionary in the industry.

In this dynamic market, Volpak ensures that pets continue to enjoy high-quality, nutritious, and sustainably packaged food, reflecting the evolving trends and needs of the industry.

Discover how Volpak's technology and experience in the sector can support your growth in the Pet Food market. Get in touch with us today.